Following the start of the Russian special military operation in Ukraine in early 2022, subsequent EU sanctions, and the sabotage of the Nord Stream gas pipeline, Siberian gas flows into Europe collapsed from 155 billion cubic metres (bcm) to under 25 bcm. Three years on, Europe’s industrial decline now appears irreversible.

For half a century, Europe’s factories thrived on a steady stream of cheap Russian gas. From Germany’s industrial heartland to Italy’s power plants, pipeline deliveries from the Yamal and Arctic fields were the lifeblood of the continent’s economy. That era is over.

The break recently became more permanent as Russia, China, and Mongolia signed a binding memorandum for the long-discussed Power of Siberia 2 pipeline. The 2,600-kilometre line will channel gas to China from the very same fields that once fed Europe.

Combined with the existing Power of Siberia 1 pipeline, China’s annual Russian gas intake is projected to exceed 100 bcm by the early 2030s—nearly matching the volumes Europe once enjoyed.

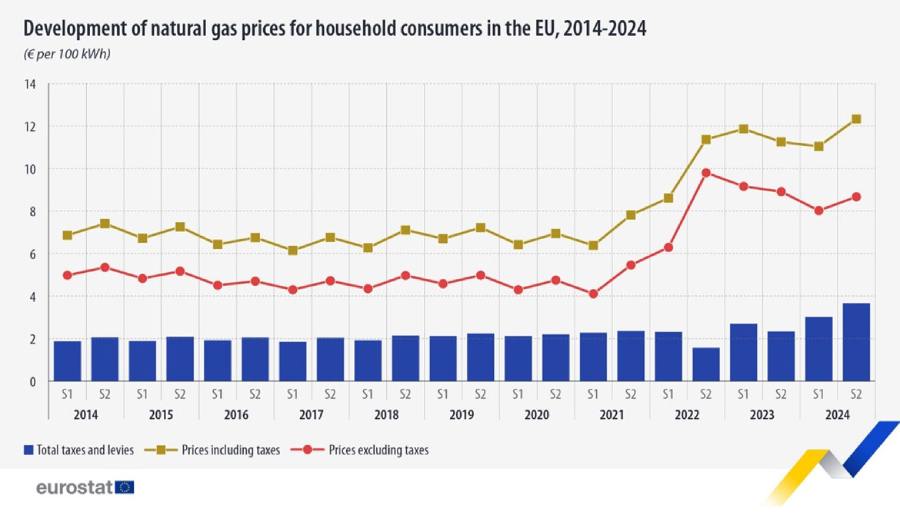

Since 2020, European wholesale gas prices have soared from €9.7/MWh to €47/MWh in 2025, according to EconJournals. Household bills have more than doubled over the same period, with Eurostat data showing an increase from roughly €60/MWh in 2020 to over €120/MWh by late 2024.

For the industry, the loss of cheap Russian pipeline gas has been devastating: Reuters reports that high energy costs have slashed margins, forced production cuts, and driven many energy-intensive firms to shut down or relocate abroad.

Corporate insolvencies hit 190,500 in Western Europe during 2024—a decade-high, Creditreform reports. European manufacturing has shed nearly one million jobs since 2019, devastating chemicals, steel, and automotive sectors, according to ETUC.

Sources

- Brussels Signal: Rise in German bankruptcies shatters hope for quick economic revival

- Creditreform: Insolvencies in Europe 2024

- EconJournals: The impact of the European natural gas crisis

- ETUC: Insolvencies in Europe 2024

- Eurostat: Natural gas price statistics

- Financial Times: Germany’s manufacturing sector sheds jobs, raising alarm over deindustrialisation

- IEA: European gas market volatility puts continued pressure on competitiveness and cost of living

- RT: Did you notice the EU just lost its gas lifeline?

- Reuters: Gas price shock set to add to Europe’s industrial pain

- Reuters: What is known about Nord Stream gas pipeline explosions

- Reuters: Putin says China to benefit from market-based gas price via new pipeline

- Reuters: German corporate insolvencies highest level in decade

- WSJ: Russia, China Close In on Pipeline Deal, Leaving Beijing With the Upper Hand