The Wallenberg Financial Family, one of Europe’s most influential business dynasties, is setting the stage for its sixth generation to take the helm of an empire valued at around $700 billion, encompassing major corporations like Ericsson, ABB, AstraZeneca, and SAAB.

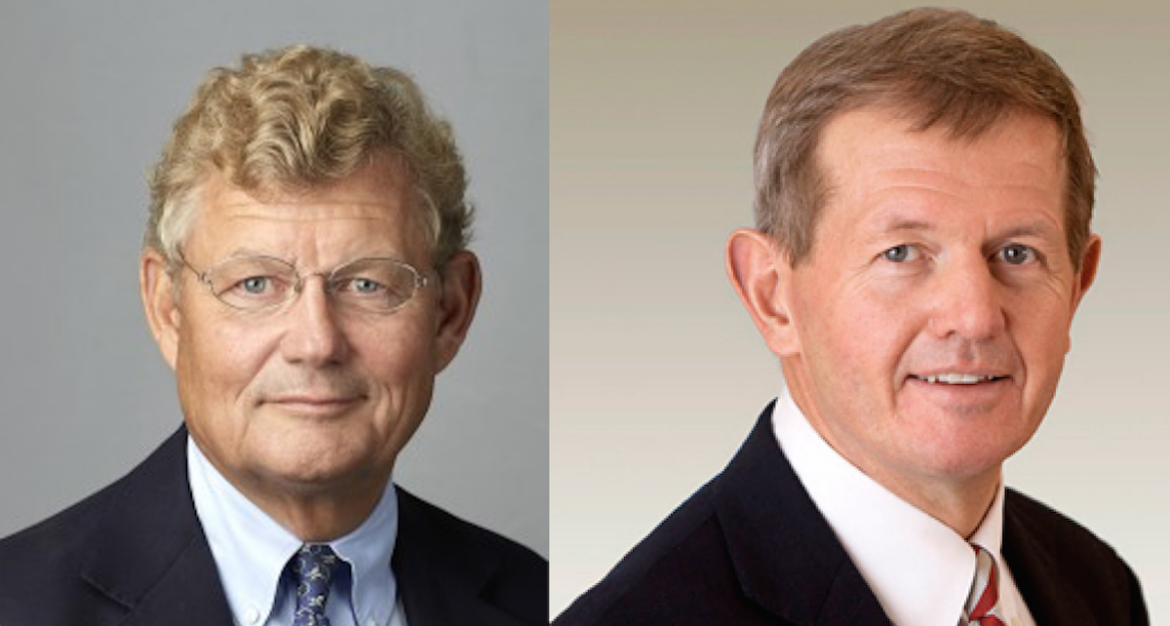

This transition, writes Financial Times, marks a significant shift from tradition as the family considers up to 30 relatives for roles in its succession planning. Jacob Wallenberg, 68, and his cousin Marcus Wallenberg, also 68, along with Peter Wallenberg, 65, are the current leaders representing the fifth generation.

“At the end of the day, we are not growing younger. What we are doing is trying to prepare for the future, trying to prepare for the next generation. Exactly how and when that happens, time will tell. But we are clearly taking steps by giving them these roles” Jacob Wallenberg told Financial Times.

They have initiated a unique approach by offering observer roles on their corporate and foundation boards to young family members aged between 12 and 45. This move, they say, is part of a broader strategy to prepare for the future.

“Everything indicates that a place is important for someone from the sixth generation of the Wallenberg family. For more than a decade, preparations have been underway for one of the 30 people in that generation to take the first step into the limelight through a more important assignment.” – Dagens Industri (Daily Industri)

Breaking with tradition

Traditionally, the Wallenberg Financial Family has been led by one to three members per generation. However, the complexity of modern business and the global economic landscape have prompted the current leaders to broaden the leadership base.

”It will be a team,” Jacob Wallenberg confirmed, indicating a shift towards collective governance. Marcus Wallenberg highlighted the expansion of family activities over the years, suggesting that this necessitates a larger team to manage the diverse portfolio which includes stakes in industrial giants like Atlas Copco and Electrolux, as well as private equity and market operations like EQT and Nasdaq.

Innovative succession strategy

The Wallenberg Financial Family’s approach includes rotating observer roles across different sectors of their operations: business, foundations, and family governance. This strategy aims not only to distribute responsibilities but also to give the sixth generation a broad exposure to the family’s extensive interests.

Marcus expressed optimism about the involvement of women in leadership for the first time in the family’s 168-year history, indicating a progressive step forward in the family’s governance structure.

Financial structure

Despite controlling vast business interests, the Wallenberg Financial Family themselves do not own the companies directly; instead, these are managed through family foundations. These foundations not only oversee business stakes but also fund significant scientific research, contributing billions of Swedish krona annually to various projects.

Wallenberg Financial Family looking ahead

The Wallenbergs are also considering diversifying their investment portfolio beyond traditional equities. Marcus noted, ”We are now digging a bit deeper into that to see how it can complement our current asset classes.” This indicates a strategic pivot possibly towards real estate, alternative investments, or other financial instruments, while still maintaining their core focus on corporate ownership.

The transition reflects a blend of legacy preservation with modern business practices, aiming to sustain the family’s influence while adapting to contemporary economic challenges. The Wallenberg family’s approach might serve as a model for other family-run businesses globally, showcasing how to manage succession in a way that fosters team dynamics over individual leadership.

As the Wallenberg Financial Family continues its legacy, the industry watches closely how this new generation will steer one of Europe’s longest-standing business empires into the future, potentially setting new precedents in family business management and succession planning.

Sources and related

- Financial Times: The Wallenbergs start succession to sixth generation

- Dagens Industri: Wallenberg krattar manegen för nästa generation

- SvD Näringsliv: ”Vi betraktar det här som ett familjeföretag”

- NewsVoice: Swedish government politics are the industry politics of Wallenberg