Hussein Askary, representing the Belt and Road Institute in Sweden, recently interviewed Professor Ding Yifan about China’s economy. Mr. Yifan is a Senior Fellow at the Global Governance and Development Institute at Renmin University and a former deputy director of the influential Institute of World Development under the State Council’s Development Research Centre.

Source: Brix Sweden interview. Ding Yifan’s book can be purchased from Peterlang.com. Visit Brix Sweden’s website: Brixsweden.org

Professor Ding Yifan shares his insights on China’s past, present, and future economic development policies. He also discusses the causes and direction of Chinese monetary policy.

Hussein Askary, and Professor Ding delve into essential questions raised in the Professor’s newly published book, ”The New Dynamics of Development: The Crisis of Globalization and China’s Solutions”.

Ding Yifan is an eminent scholar who previously served as the deputy director of the Institute of World Development under the State Council. This institute is a well-respected advisory body specializing in international and Chinese studies. It plays a crucial role in China’s decision-making process.

He is a senior fellow at the Global Governance and Development Institute at Renmin University and a professor at Beijing Foreign Studies University. He has extensive experience teaching French and has worked in France for many years. Having lived in Europe and the United States, he is well-versed in the European environment.

The interview on China’s Economy

Professor Ding Yifan: I have retired from the Chinese government think tank, Development Research Center of the State Council.

Our role is to provide thoughtful insights to our leaders regarding public policies in China. The Chinese government consults with us every time they plan to implement a reform policy, and we are responsible for analyzing and presenting the social and economic consequences of these policies in Chinese society.

We also provide the Chinese leaders with some analysis of global economies, the evolution of national and international relations, and big events that could affect the global economy. This will have a tremendous impact on Chinese development.

Hussein Askary: I would like to inquire about the opinions of Western media think tanks regarding China’s economy. These media outlets allege that the economy is not only slowing down with a 5% GDP growth rate but also collapsing. I would appreciate your response to such claims.

Ding Yifan: There have been rumours about a possible collapse of the Chinese economy since the year 2000. However, experts have analyzed China’s contribution to global growth since the 2008 financial crisis and have found that it has consistently increased over time.

It is worth noting that China’s growth rate has decelerated, but it is still remarkable. Between 2001 and 2011-2012, China experienced an extraordinary period of rapid growth, with its GDP averaging 10%. In 2007, China’s GDP rose above 13%, making it the only country to have achieved such a high growth rate.

Importantly, this period from 2000 to just after the European sovereign debt crisis in 2010 is known as the golden age of globalization. During this time, China fully capitalized on the liberalization of the global market and sold its products to various nations.

China’s export growth was a significant factor in GDP growth for almost the entire first decade of the 21st century. It became the largest exporter to every country in the world, particularly the European Union and the United States.

After the financial crisis of 2008, the global markets were already set in a particular order, and China did not feel the impact of de-globalization immediately. However, after 2010, the cooling wind from the Western world was felt more frequently in China.

This led to the prediction that China’s fast growth was over and a new phase of growth was beginning. The Chinese leaders referred to this new phase of GDP growth as the ”new normal.” It’s worth mentioning that the real estate crisis in 2020-21 is not the cause of China’s economic slowdown. Instead, a different set of factors contribute to this situation.

Hussein Askary: You say in your book that it is like a new development strategy named the new normal, acknowledging that China’s economy has entered a new period of growth characterized by a moderate growth ratio but also better-quality growth.

Ding Yifan: Where people are aware of the issue, slower growth is expected. Since 2012, President Xi Jinping has been focusing on transitioning from a high-quantity, low-end export economy to a high-quality economic growth model. This idea of new quality productive forces was also discussed in the recent two sessions of the 14th National People’s Congress. This concept has been studied for some time and is not a recent development.

Hussein Askary: Could you please elaborate on how the shift from low, high quantity to high-quality economic growth started and where it is heading? It seems that this change occurred due to changes in the global market. The Chinese government anticipated this shift and has been working to implement it in the Chinese economy.

Ding Yifan: We planned to gradually slow down the growth rate of the Chinese economy from 10% to 8%, then 7%, and ultimately 6%. This process was intended to take place over 10 years, during which the growth rate of the Chinese economy would decrease from 10% to 6%. It’s important to note that 5% was not the expected growth rate.

Initially, we expected growth to be maintained at 6% for at least two to three years. Unfortunately, the pandemic happened. It’s worth mentioning that some people blame Chinese policymaking for the economic slowdown. Still, the truth is that enormous shifts in the global economy have impacted the Chinese market and policies.

These shifts include the financial crisis in 2008, the pandemic in 2020, and the Ukraine war, which have had an enormous impact on global inflation and rising commodity prices.

All of these opinions only focus on the Chinese real estate market, but there is only some truth to them. We underestimated the consequences of the pandemic, which will impact the economy. However, the Chinese economy will recover to some extent after the pandemic.

It is important to note that the crisis has severely impacted small and medium-sized enterprises. Their balance sheets have been damaged, and many struggle to repay their debts. Consequently, financial institutions are asking these enterprises to reduce their exposure to indebtedness. However, this is easier said than done for these struggling enterprises.

As a result, many small and medium-sized enterprises have filed for bankruptcy. To help them overcome these difficulties, Chinese companies have decided to provide more liquidity to these enterprises. We are currently witnessing a return of these small and medium-sized enterprises, many of which are unicorn companies. These companies are considered technological leaders despite their size.

Their return in 2024 will likely lead to better economic performance than in 2023 and the previous year.

They control some very sophisticated technology. The only way is to provide them some liquidity to allow them to continue to develop their new technology, then to find new market, new implications to try to realize their technology innovations in the market.

That’s why we call President Xi Jinping and Chinese government leaders who are talking about the ”new quality productive forces”. New quality productive forces are emerging because we are witnessing the emergence of many small- and medium-sized technology companies.

They are developing very sophisticated technology in terms of raw materials and application mechanics, many, many of them. They are trying to implement new technology of artificial intelligence into the production process.

That greatly improved the so-called industrial revolt. This is a critical area that people need to understand. Where is China going with the new technologies? It is not only information technology or AI, but China is the world’s largest industrial economy, manufacturing sector, engineering, space technology, nuclear power, and all these things people don’t pay attention to.

Hussein Askary: There’s a lot of focus, of course, and China is leading in that, like new energy and electric vehicles. But the sectors in China you take up in your book are very, very important, and we would like to discuss them because they’re important for the world economy.

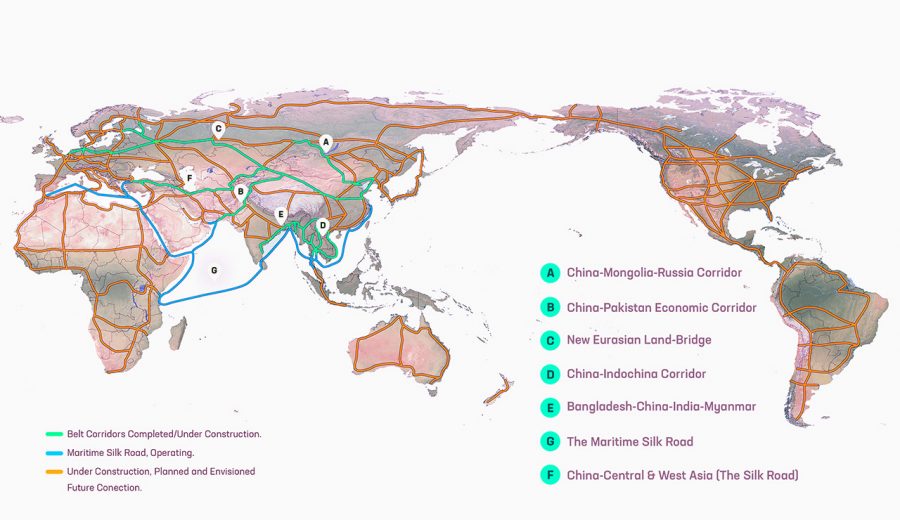

One question we will return to is the lower growth rate and China’s readjustment; some people in developing countries might be worried that this slower growth might mean China will reduce its investments in developing countries, especially with the Belt and Road Initiative.

Ding Yifan: In the first ten years, we saw a large number of large infrastructure projects and industrial projects, and people were worried. We will come back to that because you have some interesting things to mention about China’s financial policy later.

But there is a transformation from a low-end export, you know, cheap goods for the economy. Those low-end and manufacturing goods were only served to export. But now, with this higher-quality economic view, China will have to undergo a certain structural transformation, which is normal in these things.

Hussein Askary: You also mentioned the fact that China needs to get out of what is called the middle-income trap. Are we going to see unemployment rising in the low-end export industry, like in the government and textile industries, and will there be more unemployment there?

Ding Yifan: Because many other countries are taking over that. In Southeast Asia, ASEAN countries, Bangladesh, and Ethiopia even have textile industries run by Chinese companies. The Chinese are now exporting machinery from the textile industry instead of textiles, which is interesting.

But what is the government going to do? Premier Li Qiang said no stimulus packages would solve this short-term problem. This shows what Premier Li Qiang talked about: no stimulus package because it’s confident enough that Chinese companies don’t need a stimulus package to stimulate their industrial capacity.

We don’t want to push forward this enlargement of the industrial capacity. We want to upgrade the industrial production chain and provide more value-added technology products. In the industrial supply chain, the higher you upgrade to the level, the more value you have and the more profits you can get from your investments.

So that’s why Chinese people have come in to overcome the middle-income trap. You have to continuously upgrade your production to add more value to your production. Then, you can upgrade your production.

We started by making textiles and creating a garment industry. We provided many jeans, shoes, and toys. We started with this, and then we upgraded to producing electronic devices, PCs, and cell phones.

Then, we upgraded again to provide more industrial equipment. China has become the biggest manufacturer of industrial equipment nowadays. If you look at Chinese exports, Chinese exports have crossed over the relation of these products.

It started by providing cheap, low-end manufacturing goods. Nowadays, it offers electric vehicles, solar panels and batteries, and a lot of other equipment. China’s biggest export items are electric equipment, electronic equipment, big machinery, electric vehicles, and renewable energy production equipment.

That’s a big change in Chinese economic development, but also a big change in the Chinese export structure. That’s how China moved from a low-end manufacturing economy to a more sophisticated manufacturing economy nowadays.

But the question is, what will happen to the people who are dealing with the low-end industries? According to the rules of international division of labor, so China is redistributing all these production to neighboring countries, to Africa, for example.

China has built numerous industrial parks in African countries, such as Ethiopia, Kenya, and Tanzania. These industrial zones have attracted Chinese firms to invest in them, leading to an influx of international orders. Similarly, China is building large industrial zones in places like Saudi Arabia and Egypt, such as petrochemical and new energy parks.

This move towards exporting production capacity instead of just goods is a new strategy for China. Additionally, China dominates many other sectors, such as being the world’s largest manufacturer of port cranes and having an 80% share of the global market for trains used in container management, high-speed rail, subway systems, and related equipment.

Although these things may take time to be visible, they are crucial to China’s growing influence in various industries. For example, China is producing world-leading tunnelling equipment.

Hussein Askary: In your book, we have, for example, chapter two, where you go through a fascinating description of what is ”made in China”. What does it mean? And also, there’s a focus on a revolution in China’s equipment manufacturing sector, which we just mentioned, which is like, for example, Germany has been known for that.

But now China is becoming the world’s largest equipment manufacturer, manufacturing big machines that are very important to use. You mentioned, for example, China’s ”aircraft carrier”, a factory that can produce steel structures as big as a basketball court or the container of a nuclear reactor.

Can you explain why China’s ability to produce such large pieces of steel is important for the world economy?

Ding Yifan: I will take you back to China’s first generation of leaders, such as Mao Zedong and beyond, who decided to industrialize the country. They did this by introducing heavy industries, which marked the beginning of China’s industrialization.

Heavy industries, such as equipment industries, started very, very early in China, although that involved a heavy investment. That’s why the standard of living for ordinary Chinese in the 1960s and 1970s was very low.

People feel very poor because we must invest in those heavy machines in those developments. That’s why when we decided to open our market and to welcome foreign investment in China, we can provide them with solid support for these heavy industries.

And then, When we started to upgrade our technology to produce new equipment, such as you mentioned, our high-speed trains. High-speed train is a very sophisticated technology process. And hopefully, we have improved, of course.

We started to produce those machine presses, and we improved these machines with modern technology. So we have those gigantic machines that can produce very sophisticated pieces, items for assembly of these locomotives, those vehicles, and those things.

For example, the Chinese fast train, high-speed train, and bullet train- oh, people told me it’s a bullet train. It’s very sophisticated because the cover was made by once a gigantic press.

Japan has sophisticated technology, but it cannot produce gigantic presses. Therefore, they have to make two pieces and weld them together, which is less efficient than welding the locomotives as a whole, as it results in higher wind resistance forces.

In contrast, due to their strong wind resistance capacity, Chinese locomotives can be welded as a whole, which is why gigantic machines play a crucial role in producing better-quality products.

This need for better-quality products arose from the 2008 financial crisis, which forced Chinese leaders to acknowledge that they could no longer rely on Chinese exports to drive the Chinese economy.

We shifted our focus to Chinese domestic investments, especially Chinese investments in infrastructure. Ten years later, from 2008-2018, it completely changed the Chinese picture.

In 2008, we developed our high-speed train technology, but we have built no more than 300 kilometres of high-speed train and high-speed rail. Ten years later, we have built more than 30,000 kilometres of high-speed rail.

Up until the end of last year, China had built more than 43,000 kilometres of high-speed rail, which represents more than three-quarters of the world’s high-speed rail. It’s also the whole circumference of Earth, which is about 40,000 kilometres.

Hussein Askary: You have built a high-speed railway around the whole of Earth’s circumference. This is very interesting because I’m studying the evolution of the Chinese high-speed rail system and how it started. Of course, you integrated some foreign technology, but then you built your own domestic.

Ding Yifan: We absorbed foreign technology and then transformed it. We created something completely new and completely Chinese in that process. It is a very ironic coincidence that the first Chinese high-speed rail from Beijing to Tianjin was inaugurated in August 2008 at the same time as the financial crisis broke out in the U.S.

Hussein Askary: That initial crisis broke out in the United States with the Lehman Brothers Bank. It’s a very ironic coincidence. But from my study, which I will present soon on the Chinese high-speed rail, I travelled a lot with the Chinese high-speeder and also studied the background.

What you did in China by building this enormous high-speed rail system is not only to make transport of goods and persons much faster inside the country, connecting the whole country together. But as a side effect, you created the world’s largest and best construction system.

You have the best construction companies in the world. You have the best tunnelling. I travelled from Zhengzhou to Chengdu. There are dozens of very long tunnels.

It’s a mountainous area. So, in the process of developing the high-speed rail, China developed new and advanced technologies in tunnelling and bridge building.

Recently, Chinese technology has advanced for building large structures such as bridge riders and girders. This has enabled China to become a world leader in various construction sectors.

The Chinese high-speed rail has contributed significantly to the country’s economy, which is of great importance to the world economy. There is a misconception that China has an overcapacity of construction. Still, in reality, the developing sector of the world has a $4 trillion infrastructure deficit. Therefore, China’s capacity is much needed for the world’s development.

In your book, you use so many examples of innovation. So it’s very difficult to encompass everything. I only encourage people to read your book, but I want to move on to the next. Unless you want to say something about this.

Ding Yifan: I can add something because we know that developing the high-speed rail sectors will involve participation from many sectors in these new construction sectors.

And because of the historical experience of Germany, after Germany’s reunification or the creation of the German Empire in 1871, Germany started building its railway system. The construction of railway systems in Germany has contributed to the creation of many industrial sectors that have triggered everything in Germany.

So, in China, developing high-speed trails and high-speed rail has also created many opportunities, as you said, for different sectors. A shield machine or tunnel shield machine.

That’s how you can make so many tunnels. Without the construction of this shield machine, we cannot build all these tunnels and subways. Also, because we have developed the technology of these shield machines.

Since 2006, we have been developing our own technology for the shield machine. Before that period, we imported shield machines from Germany and Japan, which were extremely expensive. The way they provided those shield machines is inappropriate because the machines made in Germany or Japan cannot meet China’s special geographic conditions.

We had to adapt those machines to our geographic conditions, but you need to invite those engineers to come to China to adjust their machines to the working fields. It’s extremely costly because, you know, to recruit an engineer, you have to pay the same cost as to recruit a lawyer.

You know, how expensive is a lawyer? Well, an engineer is as costly as a lawyer. So, we must find a way to afford to continue buying those machines and implementing them into Chinese work. So, we decided to make it happen in China.

So we started building this shield machine. Nowadays, China is the biggest producer of this shield machine. China’s shield machine represents more than 70% of the global market. Not only do we use those shield machines to build and continue to build highways, but we also use the highest big rails to build those subways because, look at in recent years, in recent years, in every big Chinese city, we have been building a subway system.

In about 10 to 15 years, China’s subway system has been leading in the world. Last year, someone made a statistic about the subways and the importance of subways. Guess what? Among the 10 top subways in the world, nine are in China, in different Chinese cities.

Those famous underground systems in London, New York, and Paris are all not in the top 10 at least. So that’s how it made so much quick progress in building those subways: We built this gigantic machine, the shield machine.

Hussein Askary: You can afford to build those subway systems. Yeah, and we have here in Stockholm right now, one of the new subway lines is being tunnelled by a Chinese company because they were considered the most efficient, cost-effective, and actually even environmentally friendly construction sites.

This is a significant advantage for China. It is a remarkable achievement because you have invested in your country’s infrastructure by building tunnel systems, subways, and train systems. Now you are sharing that knowledge and also reaping economic benefits from it.

These are critical economic factors which people often ignore. They think about exports, numbers, money, and consumer goods, but they forget these very important things that are vital to the livelihood of whole societies, like a subway system, which is very important.

Ding Yifan: That’s the question you mentioned. China is turning from high-speed growth to high-quality groups. The high-quality growth concerned with all these projects improve infrastructures in China. This facilitated people’s lives, completely changing Chinese people’s livelihoods and their living modes.

Nowadays, traveling in China from city to city. It’s very easy. They live in the same city. I fly to Shenzhen. I come back. I fly to Shanghai. I come back. I take the high-speed train to go to everywhere in the north part of China.

Hussein Askary: Yeah, that’s very important. You deal with the question of the financial system, but you take up two very important questions. Everybody’s talking about, for example, the internationalization of the Chinese currency, the Yuan, and how that will affect the de-dollarisation process.

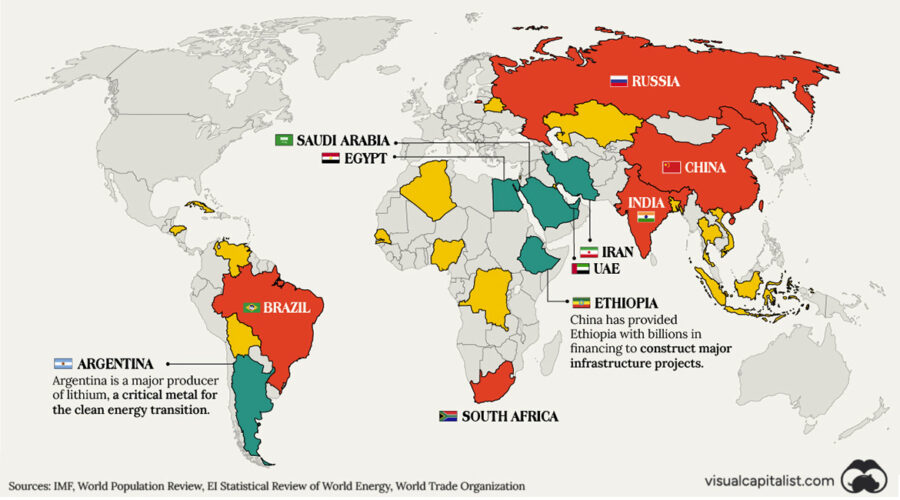

Now, we have the emergence of the BRICS countries. We have members of the BRICS countries, especially Russia, who are eager to discuss a question to replace the dollar system with the BRICS currency system.

The second question you take up is what to do with the enormous foreign currency reserves China has. You have like about three trillion dollars. What to do with that? So, the first question is about the internationalization of the Yuan.

How do you see this process going on? What is China’s position? My understanding is that China is not eager to internationalize its currency the way the dollar has been done because it wants to keep control of its currency.

Ding Yifan: China didn’t realize that international currency is so important. Actually, in 2008, the question of Chinese currency internationalization was raised and mentioned, first of all, by the British people.

Those British high-ranked officials—I don’t want to mention their name, but those very high-ranked official government officials went to me. They said that, does China have a plan to make its currency internalized?

And London will welcome off—try the Chinese currency market. So, I said Frankly, the Chinese government doesn’t think about the easy internationalization of this currency. We didn’t care so much about the internationalization of this currency.

However, there has been a need after the financial crisis because the US dollar is no longer a reliable currency. And then, in the reform of the international financial and monetary system, people are talking about the Chinese Yuan or the Chinese Yuan’s position in the world.

That’s why Chinese Yuan has been included by IMF as part of the special drawing rights. So China’s currency is becoming an official reserve currency in IMF. So as such, many countries, or in many countries, central bank, have to keep some Chinese Yuan’s assets as the composition of their foreign currency reserve.

That’s why the Chinese currency has become increasingly internationalized. But in recent years, as the United States started to weaponize the US dollar as an instrument to trap its adversaries, decentralization has been appealed to by more and more countries that have troubles with the United States.

They don’t want the US to continue to play the predominant role in the current international system. Yes, all kinds of sanctions, even after the Ukrainian War. So the United States decided to freeze the Russian central bank’s assets, and then they even threatened to confiscate those assets and reduce them.

That also happened with Afghanistan’s central bank. They decided to freeze the central bank of Afghanistan. Then, they redistributed those US dollar assets to so-called Afghan refugees. So it’s completely insane.

It’s completely illegal because those so-called other central bank’s assets in US dollars are their assets. You can mobilize, you can freeze, and you can confiscate the country’s financial assets. It’s completely, it’s a robbery.

That’s why many, many countries are talking about de-dollarization. They have decided to keep some distance with the dollars. That’s why the need for advanced internationalization has become an urgent issue in international relations.

Last year, the BRICS countries – Russia, India, Brazil, China, and South Africa – had a lot of business to do together. Previously, they settled their own business using Euro or US dollars. However, dealing with these currencies has become increasingly dangerous these days.

Recently, countries like India and Brazil have used the Chinese Yuan as a third currency to settle deals with other countries. For example, when India bought coal from Russia, they chose to use the Chinese Yuan instead of Ruble or Rupee due to their unstable nature.

Similarly, Brazil also settled a deal to buy fertilizers from Russia using the Chinese Yuan, as they couldn’t use Euros or dollars. This trend highlights the growing use of the Chinese Yuan as a preferred currency for international transactions. This trend is not just because of Chinese efforts, but due to the high demand for a stable currency, as other countries cannot offer a better option.

So, they decided to use Chinese currency as an instrument and an intermediary to solve their problem. Yeah, so the role is more to facilitate trade and to avoid all these other coercive measures by the United States and the West with sanctions.

Hussein Askary: But as everybody knows, the dollar is not only used in trade; it’s also a reserve currency. It’s used in all kinds as an asset. People keep it as an asset. Is China worried that the yuan will also become something outside of the control of the Chinese central bank and government?

Ding Yifan: Those kinds of concerns also happens at the beginning. in the United States, when Europe created the offshore dollar market in 1950s, the United States were very concerned. They said, what will be the role of this offshore dollar market or domestic market? They went to London. They went to the city. They wanted to know the consequences of the days. And then returning to Washington DC.

Those experts explained to American presidents that the creation of an offshore market can not really affect the price level because it’s the main consensus about inflation, and a lot of money was accumulated outside the United States.

They are very concerned about the impact of this liquidity in the inflation level of the United States. And then they realized that the money circulating out of the United States could not affect the price level of the United States.

We have the experience to know that offshore markets cannot significantly impact Chinese currency. The Chinese yuan is very stable, evidenced by the stable Chinese Consumer Price Index (CPI). The CPI has been stable for a long time, remaining under 2%. This stability has even led to concerns about deflation in the Chinese economy.

The yuan’s purchasing power is also stable due to this low CPI. This stability indicates that the Chinese currency will likely become a well-appreciated currency like the Deutsche Mark in the long run. It’s important to remember that in the 1970s, the US dollar devalued significantly after the collapse of the Bretton Woods System, leading to a period of global economic inflation.

The US dollar devaluated a lot, and the devaluation of US dollars caused a lot of inflation in the United States itself. Then, US inflation will have a spillover effect on Europe. So, European countries passively had a lot of negative impacts from dollar devaluation and inflation.

Because of these inflation effects, they wanted to keep their currency not pegged to the US dollar. They decided to keep some distance from the US dollar and pegged it to the Deutschmark because, at that time, West Germany’s price was the most stable.

When they decided to peg their currency to the Deutschmark, they seemed to import some anti-inflationist factor from Deutschmark. So, all those European Community countries decided to peg their currency to Deutschmark.

That makes the basis for the European monetary system. The Deutschmark is the currency of reference within the European monetary system because every country’s currency is pegged into the Deutschmark.

In the future, the Chinese yuan could play this role of anchored currency because if you look at the current inflation rate CPI level in the United States or the Eurozone, it’s much higher—much higher than in China.

And if you look at the intended level of the federal government in the United States, in Washington DC, its debt-GDP ratio is above 130 per cent. In Eurozone, it’s almost 90 something percent. It’s almost 100 per cent of the GDP.

In China, the currency is devalued by only 30 per cent, which means that China has no motivation to devalue its currency further. On the other hand, in the United States and in other zones, there may come a time when they will find a reason to devalue the currency in order to deflate their debt in real terms.

Because Carmen Reinhart and Kenneth wrote the book “This Time Is Different: Eight Centuries of Financial Folly”, they explained that historically, all European countries use the depreciation of the currency to deflate the real debt.

So yeah, so they can escape paying the debt. Yes, they can escape these things. People suspect the United States will do something similar because… debt service levels are unsustainable. They have to pay around 1 trillion dollars annually of the budget in debt service.

It becomes so dangerous. Yeah, but we must have the Chinese, they have the BRICS countries, that there is an alternative. That’s why, likely or unlikely, Chinese currency becomes an alternative choice.

We didn’t really think about China’s internalization. But alternatively, people think that they want to take some distance with US dollars or with Europe. They think that the Chinese currency could be another choice.

Hussein Askary: Well, if we go to the second part of your arguments in chapter three on the financial system, you deal with the question of what to do with China’s enormous foreign currency reserves. Now, you encourage two things.

First, on the one hand, in developed countries, China should increase its investments, or Chinese companies should increase their investments, especially to have access to high technology. However, that’s being restricted by the United States.

The other option you encourage is in developing countries, that China should increase its investment of those reserves to secure the return on investment. But how does that apply to investments in the BRI?

As I mentioned earlier in our discussion, there are many countries in developing countries. We saw this discussion during the Belt and Road Forum, which we attended in Beijing in October last year that people were talking about.

I mean, not Chinese, but foreign others, say that China is going to reduce its investments the BRI because of the financial crisis, the economic slowdown, and that China will only focus on small, beautiful things here and there, you know, things that help communities like what the EU has been doing in Africa, for example, small, small, small projects which have no real economic effect.

Ding Yifan: I would like to discuss your views on China’s investment, specifically in developing countries, as part of the Belt and Road Initiative (BRI). From my perspective, Chinese investment in BRI countries has continued to increase, and the results have been encouraging. The infrastructure investments made by China have helped these economies perform better on a global level, which in turn has improved the livelihoods and conditions for the economic development of the people living in these countries.

And so these countries attracted more and more foreign investment, direct investment because along with the improvements of their infrastructures, their condition to welcome foreign investments in manufacturing sectors gets better.

More and more foreign companies would like to invest in a better environment. So all this happens in many countries. But after 10 years of investment, we Chinese get more cautious about that. We don’t want to invest as massively as in the past because the demand is slowing down.

In China, if the Chinese government doesn’t want to increase its investment in infrastructure, like in 2008, it’s because there is no such space for investment in infrastructure. There’s not so much space for these investments.

In 2008, there was a lot of room for investment, especially in developed countries. Therefore, we invested heavily in building infrastructure during the past 10 years. Due to this, it is not feasible for us to continue investing in the same infrastructure using foreign investment.

We have to have a better selection of projects. We will continue to improve the infrastructure. But we have to make a better selection to ensure that these projects will be sure to succeed in the future.

To add more value to the local economy. Because the purpose of investing in infrastructure construction is to help the local economy get to an upper stage. So if we are sure that our investment in those sectors could improve those local economies, then we will continue to invest in those sectors.

However, we must make a more careful assessment of these investments for these purposes. Also, previously we made some decisions that were not so rational, so that didn’t reach the expectations we made for the economy.

That’s why we became more cautious. We said that if we invest, we will be sure that the result will benefit the local economy.

Hussein Askary: This is a very important point, which many people, especially the so-called observers in the Western media, really don’t understand; they have forgotten what infrastructure is.

What you do with infrastructure is you increase the productivity of the society? If you have better transport, if you have enough electricity, clean water, and skilled labor, then that leads to an increase in the economic activity of society in industries, in agriculture, and in the service sectors.

Because without infrastructure, you cannot do that. This is the responsibility of every government, but China has actually taken the initiative to help those countries build infrastructure, which, in monetary terms, is not beneficial for China.

Of course, they are beneficial for Chinese companies who can build these things and export their machinery. But if we take Africa, for example, the deficit in infrastructure is so enormous that we will need to work for a decade or two more intensively than what has been done just to fill the gap in these societies, I mean, Africa is 1 .3 billion people now.

They’re projected to become almost 3 billion people by 2015. So Africa is very promising, but President Xi Jinping said at the 2015 Johannesburg -Africa -China Summit that there are three bottlenecks of development that Africa needs to overcome to modernize and industrialize.

And that is the lack of capital, infrastructure, and skilled labour. He said that if you fill these three gaps, these bottlenecks, Africa’s economy will grow like we did in China. But China alone cannot solve all these problems.

There are 50 countries, and it’s three times larger than China inside, and it has as many people as China. So, China cannot develop all of Africa. Still, the model China has presented in Africa through the Belt and Road is succeeding and is actually very popular despite all the propaganda about the debt trap and all these things.

I think the Chinese loans to many countries are very too nice sometimes. I looked at some of these contracts, for example, with Montenegro to build a highway, very, very good project. It’s only 2% interest rate compared to commercial rates of 4% to 5%.

The loan agreement between Montenegro and China spans 20 years, which is quite long-term. During the first six years of the agreement, Montenegro was not required to make any payments, known as the grace period. While it may make sense for a Chinese company to seek a loan in China, other countries are receiving more favourable deals from China.

This is very important. However, my point is that we need not only China but all advanced economies to support infrastructure development in Africa and other parts of Asia. That’s why China initiated the creation of two completely new financial institutions.

The BRICS country’s New Development Bank and AIIB, The Asian Infrastructure Investment Bank, are two important development banks that provide more funding for infrastructure works. So the role of development is to provide long-term low interest rates for those infrastructure works.

China’s Development Bank is also a huge bank. There was a book describing the role of China’s Development Bank as a super bank in the world.

China uses its development bank, first of all, to finance Chinese-owned development. Nowadays, the Chinese Development Bank is reaching out to many countries, providing them with key funding for those needed infrastructure works.

And though those works can serve the country, can completely improve the country’s development conditions, and then providing them with basic infrastructures that could trigger other investments, so that trigger a virtual circle of development.

Hussein Askary: Well, another issue you take up in the third chapter on the financial matters, because we have now two lies circulating, is that foreign companies, like American companies, are disinvesting, they are leaving the Chinese market.

They don’t mention the fact that the US government is forcing those companies to leave the Chinese market. That’s one thing. The other thing is that they say the Chinese government has big restrictions on foreign companies to invest in China.

It’s the fault of the Chinese government. They are not so liberal in allowing foreign companies to invest in China. Now, there is a fallacy here because Premier Li Qiang, he actually said in the report to the two sessions last week, he said we have lifted all restrictions on companies who want to invest in manufacturing in China.

If you want to invest in something productive, you are welcome. But the restrictions, as you mentioned in your book, and also warn against allowing hard money, people who are out, you know, venture capitalists who want to go quickly into China, flood the financial markets, the real estate market, create bubbles and make a profit and leave the country.

I think people don’t differentiate between these two. So why do you allow the first, which is investment in manufacturing, but don’t allow the second, which is investments in the financial and other sectors?

Ding Yifan: I think you mentioned a very key point in China’s opening to the outside world. Since the beginning, China decided to open its market to welcome foreign direct investments. So, since the beginning, China has welcomed many foreign direct investments.

But China allows very few portfolio investments to come into China. These are qualified institutional foreign investors. Those qualified institutional foreign investors are allowed to come into the Chinese capital market to invest in the Chinese market but with a limited city.

They can come to China if they want to invest in the Chinese market. But with a limited amount of money, you are not allowed to invest in China massively with all your money. No, you can only come to China with some limited amount of liquidity to invest into these markets.

We want to take advantage of these institutional investors to improve Chinese portfolio investments because some Chinese companies are listed in the Chinese capital market.

Also, they want to do raise funds from the market, but we don’t have any experience. So those qualified foreign institutional investors could provide some experience by their investment in China. They can show to Chinese investors an example of how to manage those assets.

However, we don’t want to open the whole capital market because China doesn’t lack capital. That’s something very specific. China is the biggest saving country in the world. Even China used to be a poor country.

Chinese inhabitants have got the customers to save some money in the prevention of the uncertainty of the future. That’s Chinese traditions. The Chinese deeply rooted it in Chinese culture, Confucianism.

Confucianists told people that they have to manage their individual and family assets and not borrow too much money. You have to save money to manage and keep the balance of your spending and your revenue.

That’s why Chinese people get accustomed to these kinds of cultural habits. So China doesn’t lack capital. Meanwhile, many developing countries lack capital. That’s why they should keep their capital market open to foreign investors.

Even if they know that most of this capital is speculative, they still have to attract them to their market. But that’s a big risk. That’s a big risk. So… What China is doing is trying to replace the lack of capital in those countries by providing the long -term investments in infrastructures.

They have to manage short-term investments, speculative investments, and long-term investment needs. That’s why, from time to time, developing countries experience financial crises. Because they have to borrow in short -term money from those great wealthy countries, then to finance the investment in long -term.

Well, this mismatch of this mismanagement was not well-controlled. It will lead to a financial crisis. So, what China is doing is to prevent these kinds of things from happening. And to provide those domestic countries with long-term investment funding, then they will not need some short portfolio investment to keep the balance.

Then their financial market could not be more unstable because they won’t need so much short-term speculative capital in the market.

Hussein Askary: This is one of the things I discovered from studying the cases of so-called Chinese debt-trapped countries like Sri Lanka, Zambia, and Pakistan.

I looked at their books, the central bank. The crisis is not because of Chinese loans. The crisis was mostly because of Euro bonds and short-term high-interest rates. In Zambia, Zambia borrowed five-year Euro bonds for a 9% interest rate.

So these countries are in a race to borrow money from the bond markets, from American and European bond markets, to pay old debt. They don’t even invest in infrastructure or industry. They borrow money to pay old debt, and that keeps piling up.

And then you have crises like the pandemic, you have another collapse of commodity markets, the collapse of tourism in Sri Lanka because of terrorism. You know, their income was shrinking. So, they were borrowing money, not from China.

They were borrowing money from the Euro bond market and private. Eventually, they cannot control the interest rate of this Euro or dollar because the Federal Reserve or the ECB controls the interest rate of the Euro or dollar.

Jeffrey Sachs recently said African countries should borrow 10 times more to invest in infrastructure. Still, these loans should be very long-term, 20 to 30-year loans because the benefit of infrastructure comes later.

You don’t make financial benefits from infrastructure in five or ten years. If you educate a child, you can’t ask them after five years in school to pay back to society. They have to finish school; they have to go to school for 20 years to be able to pay back to society the investment which was made in their education.

And this is one of the things people don’t understand: the difference between long-term and short-term. We have taken a very long time now because the material you provide in your book is so thorough. We will just finish with one bridging question because the first five chapters of your book deal with purely economic matters, also very much related to the Chinese economy.

But then you, in the fifth chapter, have already moved into political discourse. Yes, yes. How China’s economic power will project, you know, it says China’s economic power is growing enormously. But how will that be projected as political power?

Should China’s neighbours and its partners fear this factor of China using its new economic might to pressure them politically and strategically to make concessions to China? This is a big discussion in the West.

Ding Yifan: Culturally speaking, they don’t have to be concerned by the rise of Chinese political power because a Korean scholar, an American Korean scholar, wrote a book about the history of East Asia.

And he tried to tell people that even China was much more powerful than Western powers. If you read the book of Angus Madison, you will see that he permeated British economies. He said that for more than nine centuries, for more than 900 years, China used to be number one in the world and the most powerful country in the world.

China wanted to bring peace and stability to East Asia. China never abuses power in East Asia to try to put some pressure on those countries. Historically, every time there is a disequilibrium in Asia or in East Asia, China is there to redress the justice. Because every time in East Asia, Japan is a rebellious country, a rebellious nation, you always want to make some trouble in these areas.

Every time Japan disrupted the order to invade Korea to invade China, China would try to redress the injustice, to chase away the Japanese, to reach it. China never thought of conquering the neighbouring countries.

No, but China will use these power, economic power to alluring, to allure neighboring countries to abide by Chinese order. somehow Chinese order. Chinese order is a fairness with everyone, especially with small countries.

If you visit China in Hebei province and in Shandong Province, you still have some tombs of these southeastern countries’ kings and princes because they were affected by disease and they died in China; they had power there.

And then, because in the old days, all these people wanted to come to China to try to build a friendly relationship with China because China would provide them with a lot of abundance, this system is wrongly called the tribute system.

And as if those small countries were somehow repressed by China, but in reality, Chinese emperors would give back much more gifts than they could offer to China because China is a big country, huge, and has an abundance of wealth.

So, Chinese emperors will give back many more gifts to those small countries. That’s why the closer you have relations with China, the more you can access this tribute system. Korea, for example, had better relations with China.

Koreans are allowed to participate in these so-called tribute systems twice a year. They came to China twice to bring their product. It’s a sort of official trade.

So they brought them to the Chinese emperors, and there were their gifts and products. So, Chinese emperors will give back much more to those Korean representatives. Two times every year, they get much more things from China.

Because Japan has so many troubles in East Asia, it is allowed to make these proprietary systems only once every three years. You can put it on every three years of it. So you can understand why the system is in such a way.

Hussein Askary: So you mean that the Chinese culture itself is prohibitive to this kind of manipulation of power to suppress others and but China today is China wanted to provide some incentives.

Ding Yifan: Yes, quite some advantage to those incentives and those advantage could encourage those countries to behave in such a way that is incompatible with stability and peace in the region.

China is more than the view of things. I mean, China, through the global security initiative, is arguing that we should adhere to the United Nations Charter. This is not a Chinese invention; it’s not the Chinese centre, but we need more order in the world than a new world order.

But China’s policy today is not that we have to reshape and create a new world order, but to maintain order in the world through adhering to the United Nations Charter principles, the sovereignty and independence of nations.

It is crucial to have complete security without dividing it. Therefore, the Chinese President has recently suggested a global security initiative where every country should prioritize the security of other nations.

This means that no country’s security should be considered more important than others, and every nation’s security should be taken into account. Furthermore, China’s unique perspective suggests that economic development is essential for security.

The question of security versus development is a dialectic one. You cannot have security without development, and you cannot have development without a secure environment. This is an essential aspect of what China calls for in the world order: to promote security, peace, and economic prosperity for all nations.

I believe people do not thoroughly comprehend the idea of a community and a shared future for mankind. It is a profound concept.

Source: Brix Sweden interview. Ding Yifan’s book can be purchased from Peterlang.com. Visit Brix Sweden’s website: Brixsweden.org

Related

- Read more about China and China’s economy in NewsVoice